Are you exploring ways to boost your retirement savings? A Gold IRA offers a unique opportunity to diversify your assets and shield your wealth against financial volatility. Consider the benefits of adding precious metals like gold to your retirement approach. A Gold IRA permits you to acquire physical gold, that can act as a safety net against inflation and financial instability.

- Explore the opportunity of Gold IRAs to secure your retirement future.

- Talk to a reliable financial advisor focusing in precious metals plans.

The Ultimate Guide to Gold IRAs and Physical Gold

Deciding between a Retirement Account and physical gold can be a challenging choice for investors seeking to diversify. A Self-Directed IRA offers deferred taxation, allowing your investments to accumulate over time. However, investing in bullion provides the concrete value of physical possession.

- Evaluate your financial situation

- Consult with a financial advisor

- Research different companies

Ultimately, the Gold ira vs 401k best choice depends on your specific needs.

Exploring the Gold IRA vs. 401(k) Dilemma

Planning for retirement involves carefully determining the right investment strategies. Two popular options often analyzed are the Gold IRA and the traditional 401(k). While both offer advantages for long-term savings, they differ significantly in their design. A Gold IRA, as its name implies, invests primarily in physical gold, while a 401(k) allows for a wider range of assets, including stocks, bonds, and mutual funds.

- Understanding the volatility associated with each type of IRA is crucial before making an intelligent decision.

- Gold IRAs can offer asset allocation benefits by reducing against inflation and market instability.

- On the other hand, 401(k)s often come with {employerincentives, potentially accelerating your retirement savings.

Ultimately, the best choice depends on your financial goals. Consulting with a qualified financial advisor can help you clarify these complexities and make an strategic decision for your retirement future.

Harnessing the Potential of a Gold IRA: Pros & Cons

A Gold Individual Retirement Account (IRA) presents a distinct avenue for investors seeking to protect their portfolios. By investing in physical gold within an IRA, individuals can potentially benefit from its historical stability as a reserve asset. However, it's essential to meticulously analyze both the pros and disadvantages before making a decision.

- Amongst the strengths of a Gold IRA is its potential to shield your assets from inflationary pressures.

- Gold has historically served as a consistent hedge against inflation during times of economic instability.

On the flip side, there are key drawbacks to keep in mind. One significant factor is the potential formaintenance expenses. Additionally, accessibility can be a concern with Gold IRAs, as converting your gold holdings may necessitate delay.

Can you a Gold IRA Worth It? Weighing the Advantages and Disadvantages

A Gold IRA provides a unique approach for investors seeking to mitigate their portfolios. While real gold enjoys a long legacy as a valuable commodity, the decision to purchase in a Gold IRA requires careful consideration.

Let's explore some of the key advantages and disadvantages to aid your decision-making:

- Growth prospects

- Protection against inflation:

- Favorable tax treatment

Conversely, Gold IRAs also involve some challenges:

- Difficulty selling gold quickly:

- Ongoing expenses associated with storing physical gold

- Potential for losses due to price swings

Ultimately, the choice of whether or not a Gold IRA is right for you factors on your individual circumstances.

Secure Your Future: Why Invest in a Gold IRA

Planning for a comfortable retirement requires careful financial planning. Traditional savings accounts and holdings may be impacted by inflation and market volatility. A valuable tool to diversify your portfolio and protect your nest egg is a Gold IRA. This type of retirement account allows you to invest in physical gold, offering a tangible asset that has historically preserves its value over time.

- Advantages of a Gold IRA include:

- Hedge Against Inflation:

Gold is known as a stable asset during times of economic uncertainty, potentially buffering the effects of inflation on your savings. - Diversification:

Adding gold to your portfolio can lower overall risk by evening out the volatility of traditional assets like stocks and bonds. - Tangible Asset:

Unlike paper assets, gold is a physical commodity that you truly control. This provides a sense of security and confidence in your investments.

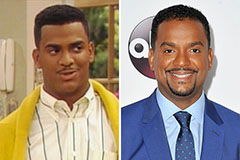

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!